|

|

|

|

|

|

main page >> |

|

C r e d i t E X P O . B u s i n e s s 2 0 0 6 : B U S I N E S S R E A L F I N A N C I N G ! On 10-12 October 2006, the Central Exhibition Complex “EXPOCENTR”, pavilion 7 (hall 1), hosted the Fourth Moscow International Trade Exhibition “CreditEXPO.Business 2006”. The exhibition was implemented by the International Fairs Agency “IFA” and the Association of Russian Banks, with Vneshtorgbank-24 being the project’s strategic partner. The forum was supported by the RF State Duma, Moscow Department for SME Support and Development, Moscow International Business Association (MIBA), Moscow Association of Entrepreneurs and Russian SME Support Agency. The project has set its main focus on the development of SME lending market, bearing in mind that small business is viewed as the principal driver of the economic growth. This goal was in line with the Program on SME Lending Support recently adopted by the Russian Government. The exhibition “Credit-EXPO.Business 2006” presented the diversified lending and financial services to small enterprises. 30 financial companies and banks from Russia, France and Germany demonstrated their skills and opportunities at the exhibition. The exhibitors not merely gave an insight into various credit products to every entrepreneur, but also helped obtain loan decisions immediately at the stand of a chosen company. The three days of the exposition have attracted to ZAO “Expocentr” site many representatives from commercial banks, insurance and leasing companies and mass media. At the inauguration, wishes of success to the new and promising undertaking were expressed by: S.M. Levit, President of the International Fairs Agency IFA; J.I. Kormosh, Executive Vice-President of the Association of Russian Banks; A.E. Podenok, MAE President; E.D. Shabardina, Director of the “EXPOINEX” of the Central Exhibition Complex “EXPOCENTR” and other officials. In his speech, Jury Ivanovich Kormosh noted, “We highly appreciate the implementation of such an exhibition and think that this exposition is unique for promoting different companies to the Russian finance and lending market, both Russian financial institutions and western companies. On behalf of the Association of Russian Banks, we express our hope that this exposition will become a remarkable event for Moscow’s business community that would offer long term and mutually beneficial contacts to a vast number of consumers”. IFA President Sergey Levit stated, “We are trying to develop a meaningful program for “CreditEXPO.Business 2006”, viewing it as a professional event frequented by trade visitors who really value their time. The three exhibition days provide for a large-scale demonstration of Lending to Small and Medium Business sector, Business Insurance sector and offer to the exhibitors a unique opportunity for building direct contacts with small and medium businessmen from all regions of the Russian Federation”. This year the exhibition area covered more than 700 square meters. The following exhibitors presented their displays: Vneshtorgbank-24, the International Bank of Moscow, BSGV, KMB-Bank, Daimler Chrysler Automobiles RUS, Rosbank, Orgrassbank, SOYUZ Bank, Ingosstrakh, Neftyanoi Alliance Bank, ROSNO Insurance Company, Vitas Bank, Rus’ Bank, Impexbank, Probusinessbank, Absolut Bank, Skania Leasing Company, Gran Moto (Ducati) Company, FB-Leasing, FORUS-Bank, OPM-Bank, SG “Gefest” and others. The number of visitors: about 2,000 professionals from 40 Russian cities: 73% of visitors are potential borrowers; 27% visited the exhibition “CreditEXPO.Business 2006” for the first time; 83% said the exhibition had met their expectations; 62% of guests are planning to visit the April exhibition “CreditEXPO.Business. 2007”. Retail/Corporate Client/ Line of Business:

What sectors are interesting to you?

What is your business?

What Russian region did you come from?

The average amount of staff

Visiting Purpose

The quality of services provided by the organizers is:

The quality of the showroom area is:

To what extent did the exhibition meet your expectations?

To what degree did the quality of visitors correspond to the exhibition topics?

Have you established new business contacts at “CreditEXPO.Business 2006”?

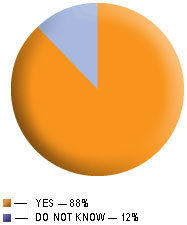

Are you planning to participate in CreditEXPO 2007?  Exhibition and the conference received wide media coverage. The majority of exhibitors say that the 2006 exhibition has improved the professional level of contacts. Traditionally, the IFA starts the opening days with the Grand Rewarding Ceremony in three nominations. The organizers and visitors awarded the “BEST STAND” to Mercedes-Benz and Avilon Center which demonstrated to guests and forum participants an original expositional design, team-work and hospitality. The Mercedes-Benz stand introduced the updated version of E-class Mercedes-Benz. The represented E 280 4MATIC meets businessmen’s high demands for comfort and safety. The skilled sales managers from Avilon Center consulted their visitors on state-of-the-art technologies which were implemented in the renovated E-class Mercedes-Benz. Moreover, the visitors had a perfect opportunity for understanding the advantage of E-class Mercedes-Benz in a personal test-drive on Moscow roads. IMPEXBANK’s stand has also won praise from the organizers and visitors in “THE MOST ORIGINAL EXPOSITION” award for its original design and most impressive presentation of bank’s opportunities under its SME lending programs. Since April 2006, IMPEXBANK has been operating as a subsidiary of Raiffaizen International Bank-Holding AG, running 16 subsidiaries and leasing companies in Central and Eastern Europe. The exhibitor company “ORGRESBANK” won the “EXHIBITION BRILLIANT DEBUTANT” award. This company is a first time participant, yet it has roused a genuine interest. According to the organizers and visitors, the participation concept suggested by the bank has transformed into a spectacular debut through the professional presentation of image goals at the exhibition. The bank’s program consists of three principal parts focusing on convenience for its clients in terms of a wide product line, prompt decision-making (only 3 days) and individual approach under flexible terms. This program has been widely implemented in Moscow. The initial pilot projects are currently underway at the bank’s first branches in Saint-Petersburg, Samara, Saratov and Penza. The Fourth International Practical Conference “Cerdit-Russia.Business 2006” was also initiated as part of the exhibition, targeting credit and finance market professionals. The conference was implemented with the immediate support from the Association of Russian Banks (ARB). The conference sponsors were: the National Bank “TRUST”, MDM Bank, “Geometria Razvitiya” company and “INTELIS-otsenka”. Vneshtorgbank-24 was the strategic partner of the forum. The conference delegates included leading market experts, government officials and financial associations, senior managers from various Russian and foreign banks, credit bureaus, insurance, leasing and investment companies, and, certainly, SMEs. The conferences devoted to various regional problems aroused an immediate feedback and increased interest among the delegates. The conference sessions considered various issues of governmental policy in SME lending, world practice, role of banks in lending to small enterprises, deposit and risk insurance in lending, non-banking lending, mechanisms for increased SME lending and others. Implementing the organizers’ concept, the Forum has turned into a dialogue with legislators, banks, insurance and consulting companies on the one hand, and the Russian SME representatives on the other. The speakers at the conference Plenary Meeting were: Anatoly Aksakov, vice-chairman of the RF State Duma Committee for Credit Institutions and Financial Markets; Vladimir Kievsky, vice-president of the Association of Russian Banks (ARB); Alexander Ioffe, president of the Russian SME Development Association; Andrey Podenok, president of the Moscow Association of Entrepreneurs (MAE), Natalia Larionova, head of the Department for Regulation of Business, Competition and Publicity of the Department for the Governmental Regulation in the Economy of the RF Ministry for Economic Development and Trade. The participants have shown an increased interest to the presentation by Alexei Ermolaev, executive director of the Moscow City SME Lending Support Fund established by the Moscow Department for Support and Development of Small Business. The conference participants were particularly concerned about regional entry. The managing director of the Department for SME Lending of Vneshtorgbank-24 shared the development prospects of SME lending market in the regions. A special conference session was held on SME lending, which was interesting to all conference delegates and particularly to those who represented small entrepreneurship. The speakers included the first ranking officials from the leading Russian and foreign banks, credit bureaus, representatives from insurance and legal firms, leasing and factoring companies and collecting agencies. The representatives of Intel Russia/CIS and Cisco Systems Capital have introduced the innovative IT technologies market for lending. The conference hosted over 200 delegates representing 140 Russian, French, German and CIS companies. The representatives of Moscow and regional companies from 20 main Russian cities were among the delegates. The participants think that the favorable environment of a dialogue created by the conference organizers has made this event highly successful. Large Loans to Small Business IRINA ZAMULINA, 16 October, 2006 Experts estimate SME lending demand at 30 billion of dollars Small business would never grow up alone even if nobody keeps the growth down. The best lending programs can offer a helping hand to such enterprises. This idea came through the presentations at “Credit-EXPO.Business 2006” conference held for several years. However, this year the number of entrepreneurs participating in the exhibition was twice less than last year. President of the International Fairs Agency IFA LLC Sergey Levit believes that disappointment among the entrepreneurs is the reason for such turnout, as many small commercial businessmen have given up the idea of obtaining the essential amount of loan support for their enterprises. Today, many small businessmen get retail loans “for personal needs” in an attempt to satisfy the essential needs of their companies. But more than often they have no chance of obtaining long term loans for a period they need. Besides, unaware of the true financial purposes of lending, a bank would not raise a loan limit to such a borrower. Experts put SME lending demand at 30 billion dollars. At the same time, the overall banking proposal amounts to 5 billion dollars. Among the reasons for the lack of interest among banks to this lending segment, the experts indicate a “non-transparency” of small business. Many small enterprises have a simplified accounting system that does not show their effective income. As a result, the banks are unable to make correct assessments of such businesses versus their ability of debt service. Hence, credit organizations would rather reject such a borrower than take higher risks. A good or, as bankers say, a liquid collateral would help a borrower obtain the necessary sum of money. But small businesses are usually unable to give costly assets on pledge. Anatoly Aksakov, vice-chairman of the RF State Duma Committee for Credit Institutions and Financial Markets, thinks that the Government is able to provide solutions to these challenges through the creation of a “comprehensive system of lending to small business”. It is particularly important to develop detailed pledge legislation in this context. In his opinion, it should include a clause on registration of movable property. Pledge laws will be designed to simplify the lending procedures for small entrepreneurs. Today the bankers still choose an easier cooperation with big companies. Marketing teams studying this market sector for banks determine the rates of small business growth “by eye”, since the only source of information available to them is tax accounts, which is not enough. Collaboration between banks and small enterprises requires the development of special lending programs, giving consideration to their specifics and needs. The statistics from the Association of Russian Banks (ARB) indicates that not all lending organizations are willing to move from the stereotype of large-scale corporate lending. Yet, the picture is not all gloomy. According to ARB Vice-president Vladimir Kievsky, mentality changing process is underway: in 2004, lending policy was developed at 30% of banks, while in 2006 this is true to 53.6% of banks. Many small regional banks set their lending focus on small business. ARB research indicates that such credits range from 40% to 90% of loan portfolio in many regional banks. However, the major players like VTB-24, Sberbank RF, Soyuz Bank, KMB-bank and others are entering this area with their own elements of small borrowers’ evaluation. The foreign players with “long” money demonstrate an increasing interest to small enterprises. The experts say that the latter are looking for a competent businessman who is able to describe his business and see its development prospects. In the short run, the Russian banks will rely on similar evaluations of small business.

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

| Ïî âîïðîñàì ðàçìåùåíèÿ ðåêëàìû íà ñàéòå îáðàùàéòåñü ïî e-mail: ce@ifa-expo.ru | ||

| © 2024, IFA Russia. | ||